In 2019, US presidential candidate Andrew Yang proposed a $1,000 monthly payment to all American citizens. Yang suggested the government give this payment equally to all citizens regardless of income. What Yang proposed has been termed Universal Basic Income, or UBI for short. While the idea has been around for a long time, it started gaining steam around 1920, when English philosopher Bertrand Russell advocated it. Today, it has many supporters, as individuals from Bill Gates to Edward Snowden and Joe Rogan support it. Their justification for a UBI centers around the concept of technological unemployment. Technological unemployment is the idea that machines are rapidly replacing humans in the workforce. Many studies have found this trend to be actual. A 2013 study found that 47% of US jobs were at risk of automation. The 2016 economic report to the president estimated that 83% of jobs with an hourly wage below $20 were at risk of automation. In 2018, British businessman Adair Turner stated that it would be possible to automate all jobs by 2060. Most academic studies conclude that technological unemployment is a real and existential threat to American workers. The threat of technological unemployment is the reason for the rise in the popularity of a UBI.

Many questions remain about a universal basic income. Would it cause inflation? Laziness? Degeneracy? One issue that should be discussed more is where the funding for a UBI would come from. It would, of course, come from increased taxes. It’s the same old plan. Take from one group and give to another. Its proponents assure us that the effect on the middle class will be neutral. The higher taxes they pay would be offset by the UBI payment they receive. The net losers would be the rich, and the net winners would be the lower classes, who are most at risk of being put out of jobs by automation and technology. In practice, it would be different. The wealthy would likely use their tax attorneys to transfer the tax burden to the middle class, and the middle class would end up paying for the UBI. So, the apparent answer to the problem of technological unemployment is to take money from the middle class and give it to the lower class. Not the most original of ideas.

Over a century ago, a similar – but yet very different – idea was proposed by someone named CH. Douglas. Douglas was a Scottish engineer and pioneer of the social credit economic reform movement during the first half of the 20th century. During WWI, while working at the Royal Aircraft Establishment in England, he noticed that the weekly total costs of goods produced were greater than the total sums paid to workers. Douglas collected data from over 100 large British businesses and found that in every one of them the workers were not paid enough to buy back what they had made. He formed ideas about why this was so and what we could do to correct it. He then spent the rest of his life writing about and promoting his ideas, which he labeled “Social Credit Economics.” His main finding was that in industrial economies like the United States, the population never has enough money to purchase what it has produced.

As a hypothetical example, say the United States produces one trillion dollars worth of goods a year. For such production, its citizens might be paid in wages, salaries, and dividends, say, five hundred billion dollars. One-half trillion in cash will not purchase one trillion worth of goods. That, according to Douglas, is the central problem in economics today. He called it the “gap between prices and incomes.” What is the cause of this gap? Douglas determined that in industrialized economies where the bulk of the goods are manufactured by machines, purchasing this machinery with bank credit—money that did not exist until the machinery was purchased—causes the consumer pay cycle to permanently lag behind the producer cycle. In other words, manufacturers inflate the prices of their goods to pay back bank loans on the machinery used to manufacture them. Since, when the loan is repaid, the bank destroys it (but keeps the interest), prices are left inflated with no corresponding increase in consumer purchasing power. This appears to be the unavoidable result of a system where bank loans cycle in and out of existence.[1]

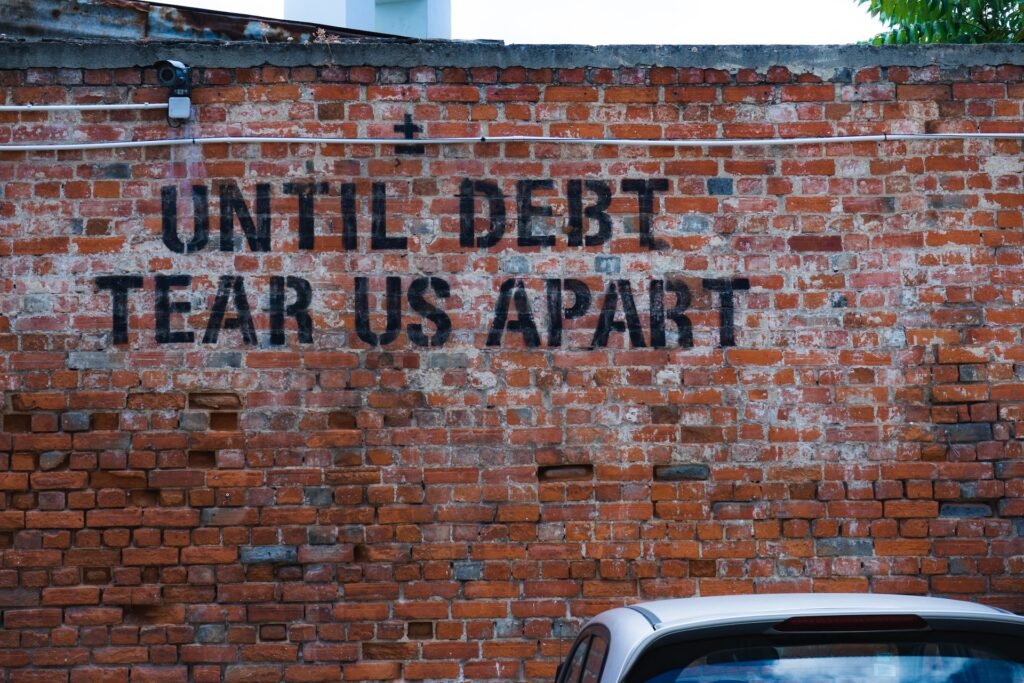

Today, a myriad of techniques are used to close this price-income gap. Some examples include distributive taxation (taking the savings of the middle class and giving it to the lower class with the hope the lower class would immediately spend it), war expenditures (war manufacturing puts money in the worker’s pocket but no goods on the shelf as the goods are not for sale and are quickly destroyed anyway), or exporting more than importing (manufacturing for export puts money in the worker’s pocket but no goods on the shelf). Even such ridiculous schemes as stimulus checks have been tried (where governments borrow money from banks and pass it out so consumers would have the purchasing power to buy the surplus goods on the market). However, the primary methods used to fill the gap are forced economic growth and consumer debt. Since forced economic growth puts money in consumers’ pockets before it puts goods on the shelf, it can temporarily fill the price-income gap. Not only is forced economic growth destructive to the environment, but it is also a live-now, pay-later scheme, as its long-term effect is to increase the gap, not decrease it. With consumer debt, banks “print” money out of thin air and loan it—at interest—to consumers so they can purchase the surplus goods on the market. These loans are a dead end, and consumers go further and further into debt over time.

Douglas’s idea for closing this price-income gap was something entirely different. He would create a National Credit Office that would calculate, as closely as possible, the money needed to fill the price-income gap and give that money, free of charge, to the population so they would have the purchasing power to buy the surplus goods on the market. His distribution method would take two forms: the price adjustment mechanism and the national dividend. The price adjustment mechanism would work as follows: periodically, the NCO would calculate the fair price (the cost of production, not including the capital loan repayment option) of products on the market vs. their actual selling price. It would then encourage retailers to sell at the fair price and compensate them for the difference.

For example, assume a product usually sells for 100 dollars, but the fair price is calculated to be 55 dollars. The retailer would sell the item for 55 dollars, and the NCO would compensate them for the missing 45 dollars. Participation in the program would be voluntary, but if one business participated, their competition would likely follow suit. If the national discount were insufficient to close the price-income gap (and it likely wouldn’t—at least not in the US), the NCO would calculate the needed money, divide it by the number of citizens, and send it out as the national dividend. Where would this money come from? It would be “printed” out of thin air. The NCO would grant itself the ability to conjure money while simultaneously removing the banks’ ability to do so. And, since the National Discount and the National Dividend would be calculated as closely as possible to fill the price-income gap, they would not be inflationary but would lead to a state of economic homeostasis. Two things should be noted here: First, social credit is not redistributive; it does not rob Peter to pay Paul. And second, the price-income gap is highly correlated to the number of machines in the workforce. More humans in the workforce? Less of a gap and, consequently, less of a dividend. More machines in the workforce? More of a gap and more of a discount and dividend. So, unlike the UBI, Social Credit adapts to growing technological unemployment. As machines keep retiring humans from the workforce, the National Dividend grows larger and larger until we reach a “post-scarcity economy,” and the National Divine becomes the sole source of income for the citizens—or at least in theory.

A post-scarcity economy is a futuristic society where machines do all or almost all of the work for humans, and the basic necessities of life are all essentially free. Whether we will reach such a society is debatable, but we are unarguably headed in that direction. In this hypothetical society, if we used money as a ticketing system—and we likely would—humans would pay machines for their goods and services. Once paid, machines would need to return the money to the human population in some manner so they could purchase the next round of goods and services. How exactly would this work? With our current system, all the “profits of the machines” would go to the machines’ owners (i.e., Wall Street), even if their owners made up only a tiny percentage of the human population. So, as technological unemployment increases, the gap between the rich and poor will grow until a small oligarchic few end up owning everything. They would then be obliged to give handouts to the unemployed in the form of a UBI.[2]

Under social credit, the “profits of the machines” would be returned to the population without first going through the oligarch’s hands. It would resemble collective ownership of all the machines that do society’s work. Douglas felt the national dividend should be passed out evenly to all citizens and used a concept called cultural inheritance to justify this. Cultural inheritance might be defined as all the inventions, discoveries, ideas, concepts, etc.—developed by people long since dead—that formed our civilization today. Since cultural inheritance is, at its base, the cause of the price-income gap and the source of all the surplus today, all citizens who inherit this culture have a right to an equal share of it. Therefore, according to Douglas, we should pass out the national dividend equally.[3]

While this concept seems solid as far as it goes, there is one thing Douglas could not foresee: the rise of multicultural society. If you gather people from all over the world of different races and cultures and have them all live together in the same society, do they have the same cultural inheritance? Do they have a right to an equal share of the national discount and dividend? To answer this question, we must look at the cause of the price-income gap. Today, and even more so tomorrow, the price-income gap is caused by technology or machines in the workforce. The more technology in the workforce, the larger the gap. And all this technology—artificial intelligence, automation, self-driving trucks, self-replicating nanobots, etc.—that threatens to put so many people out of work is the offspring of natural science. As shown in a previous essay, natural science is not the product of everyone—or even of all Europeans—but specifically of the Nordic racial type. The Nordics did not pursue natural science because they were smarter than or more ambitious than anyone else. They pursued it because they had higher consciousness. They have an increased capacity for awareness outside their ego or group. They became so fascinated with nature that they couldn’t stop investigating it. The result of this ceaseless investigation is all the technology that threatens to put so many people out of a job today.

So, the answer to the above question is no; in a multicultural society such as the US, not all citizens have a right to an equal share of the national dividend. The Nordic racial type has a right to all of the national dividend. That doesn’t mean he can’t share. That doesn’t mean he can’t be generous. It means that, in the end, he has a right to his creation. Therefore, in this revised version of Social Credit, white Americans would receive the bulk of the national dividend, and non-white Americans would receive a smaller amount – if any. The decision of who gets what amount would be made by the leadership class. The reasoning here would be that not everyone would benefit from increased leisure. Some may find it a blessing, and some may find it a curse. The dividend might have to be adjusted to fit the needs of different groups.

In summary, we live in a world where technological unemployment will likely keep growing every year until few, if any, humans will be needed in the workforce. Machines, which will now produce all needed goods and services for the human population, will generate enormous profits for their corporate owners and result in a two-tiered society: the ultra-rich and the desperate unemployed masses. The UBI is touted by many as the solution. A UBI will amount to welfare given by the ruling class to the peasants to keep them from starving. On the other hand, social credit using the concept of cultural heritage or cultural inheritance would return the “profits of the machines” to the masses. The reasoning is that today’s technology is a gift from the past, and everyone who inherits this past in the form of culture deserves an equal share of the profits of this gift. The big question under Social Credit would then become obvious. What is everyone going to do with their free time? Could they use it effectively? Would they become degenerate? Would they just stay drunk and commit crimes? This modern version of social credit recognizes that in a multicultural society, not everyone has the same cultural inheritance, and the national dividend should be distributed unequally. The reasoning here is that the leadership class, the most gifted members of society, are the most closely related to the pioneering natural scientists responsible for modern technology and, therefore, should inherit the most. Predominantly Nordic white America would be a close second, and non-white America, having little or nothing to do with the advent of science or technology, would inherit the least. These questions—technological unemployment, post-scarcity economics, and who the profits from the technology that keeps putting Americans out of work belong to—are questions for the future. Still, it is a future that is rapidly approaching.

[1] When a bank loans money, it does not loan its own or depositors money; it “prints” the money out of thin air and loans it. This is how new money is created. When the loan is repaid, the principal is destroyed, but the interest is not. The interest is the bank’s reward for the privilege of printing money.

[2]The UBI would likely take the form of a CBDC, or central bank digital currency. A CBDC is a cryptocurrency that requires the government’s permission to make transactions. For instance, if the government wanted to impose a travel ban, it could enforce it by blocking citizens’ debit cards from working outside a certain radius of their homes.

[3] Douglas developed his ideas while living in Scotland over 100 years ago. Scotland, at the time, was one of the most homogeneous and Nordic countries on the planet. So, it’s easy to see how Douglas could have looked around his country and come to these conclusions.